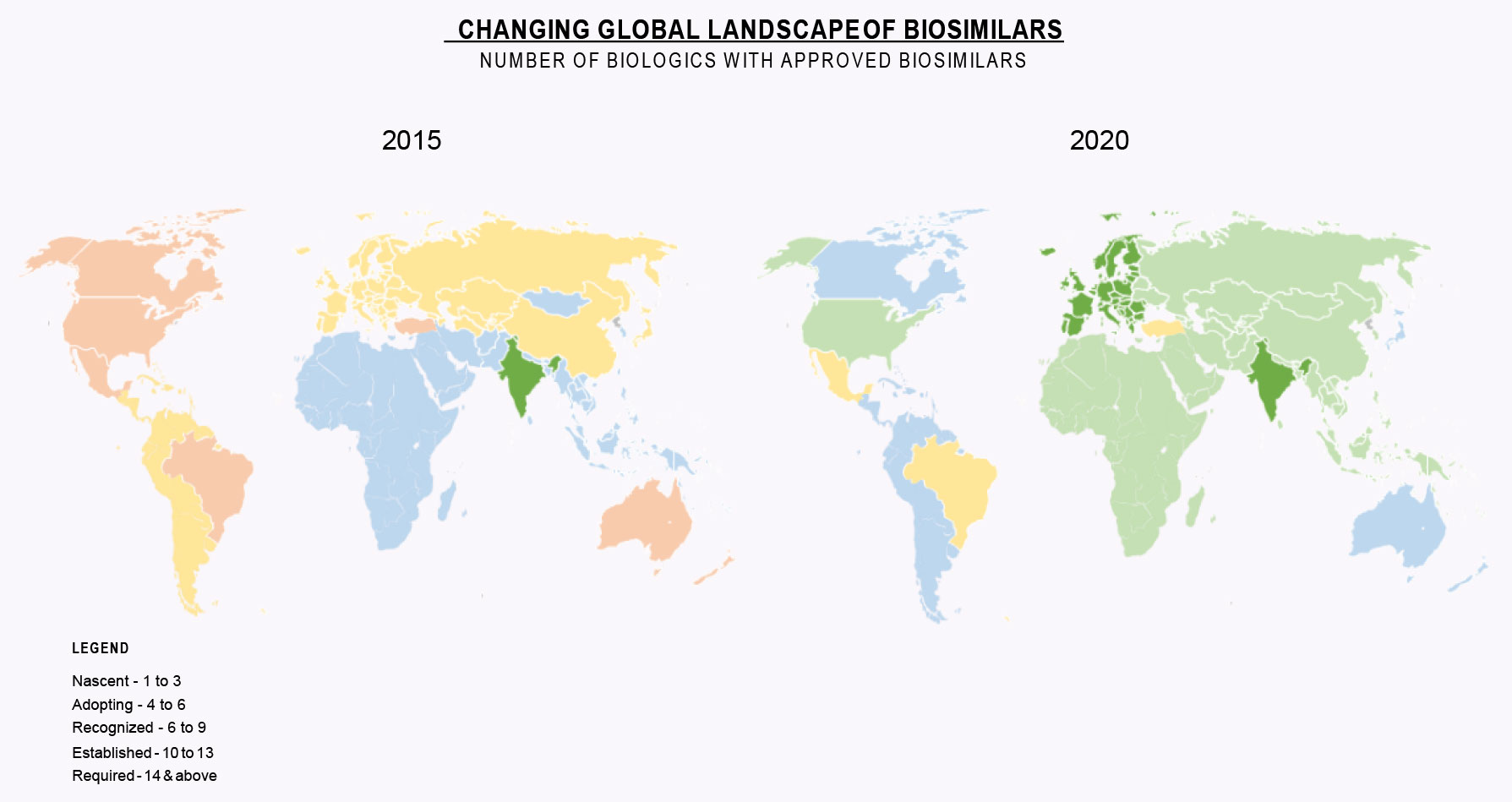

Our first white paper, Biosimilars Come of Age, highlighted growth in Biosimilars from 2015 to 2020. Vast majority of the world has moved into the Established Phase for Biosimilars. EU and India are in the Required Phase with others close behind.

As mentioned in white paper I, the major question in the biosimilar industry is sustainability. Many companies have come and gone in the biosimilars space. Are biosimilars only viable for first wave blockbuster products? Are prices being driven too low to justify development of biosimilars that will enter the market in the back half of the decade? Who will develop biosimilars for smaller revenue products?

Our goal is to outline what we believe is a viable path to ensure biosimilars are available for practically all biopharmaceuticals regardless of market size. We will show over a series of articles how we believe one can build a profitable business of biosimilars earning IRRs of over 30% including the cost of building manufacturing facilities, developing products and commercialization with little risk. How many other pharmaceutical projects can match this at the beginning of a project?

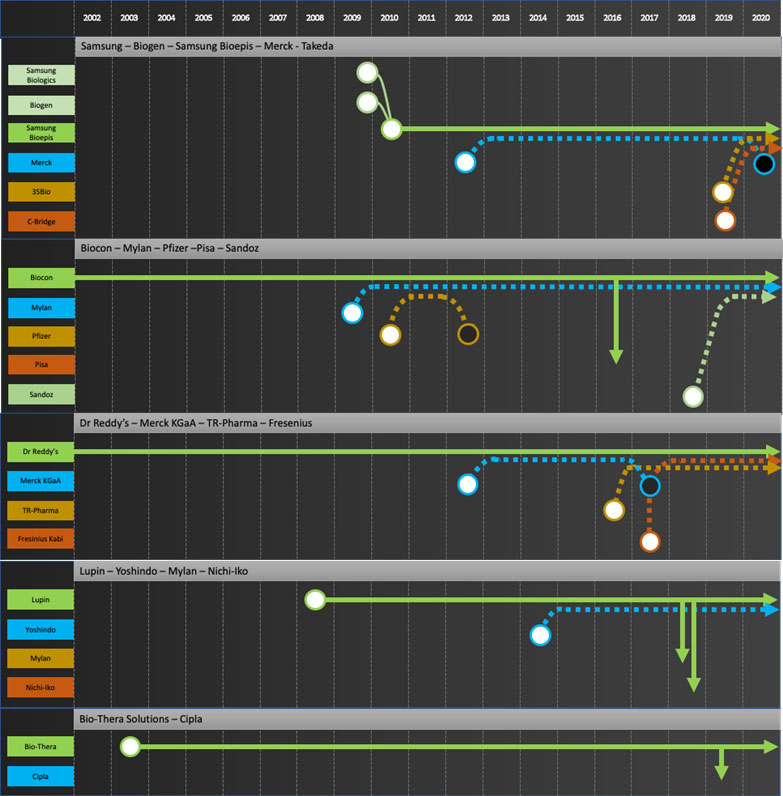

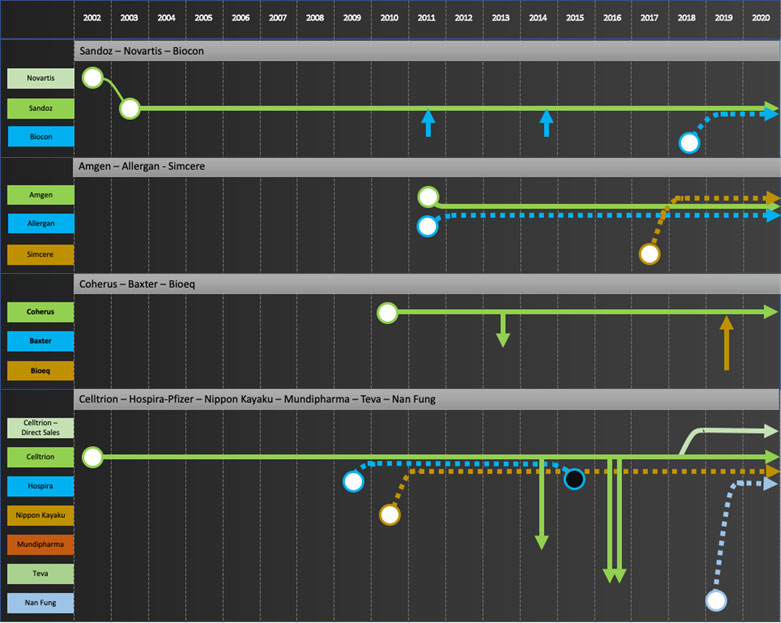

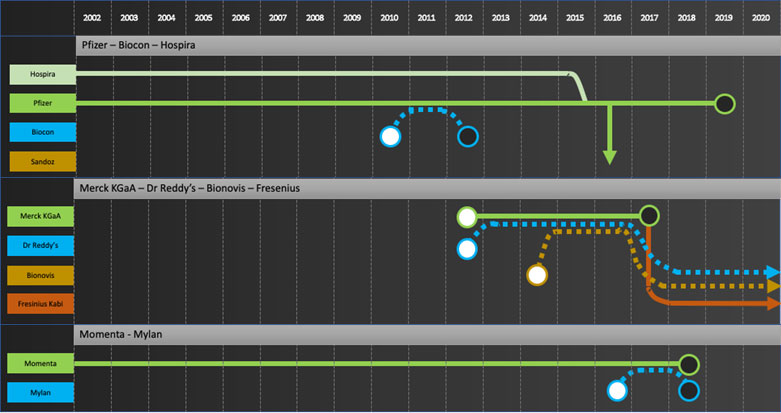

In this second white paper, Evolution of the biosimilars Industry, we focus on how industry players have entered and, in some cases, exited developing and commercializing Biosimilars. This is helpful to predict how the market will continue to develop.

In the early 2000s, companies started to develop what were then called “follow-on biologics”. Most of the initial players developing products were either generics companies or in some cases startups. The belief was “follow-on biologics” would eventually follow a generic industry path. Major pharmaceutical and biopharmaceutical companies weren’t interested in these products.

Sandoz, which became part of Novartis and originally started producing biopharmaceuticals as a CMO, was the first major player to enter the biosimilar industry. They remain one of the key players today. Other companies like Teva acquired smaller companies with biosimilar portfolios and attempted to develop their own products. By the early 2010s, many major pharma companies had biosimilar development efforts, others like Biogen and Merck formed partnerships, many smaller companies including startups dedicated to biosimilars entered the field and generics companies from emerging markets (e.g. Argentina, India, Russia, etc.) entered into major partnerships to bring their “biosimilars” to the US/EU. Only a handful of biopharmaceutical companies, notably Genentech/Roche, stated they would not develop biosimilars and focused instead of developing new therapies.

This large effort involving more than 30 different companies from around the world developing a small number of products and focused mainly on less than 15 “blockbuster” products inevitably led to consolidation. Only one startup, Coherus, survived to commercialize its own developed product in the US or EU. Many large pharma companies including both Merck and Merck Serono KGA decided to exit the field after significant investment and in some cases like Pfizer launching products.

What is left are three categories of companies which can be categorized as the developers, the commercializers and the integrators. Another group, the exiters, choose to exit the biosimilar industry and focus on other priorities, presumably because other priorities have higher returns. We profile the following leading biosimilar players, grouped into their respective categories:

- The developers: Develop biosimilars for global markets. May commercialize by themselves in domestic and emerging markets. These companies have the technical skills to develop products but realize commercialization in developed markets requires specific skills and payer/trade relationships one cannot build just for biosimilars.

- Samsung Bioepis, Biocon, Dr Reddy’s, Lupin, Biothera, Henlius, Prestige, Biocad

- The commercializers: Focus on commercializing in-licensed products in developed markets. These companies leverage their ability to get products approved and existing payer/trade relationships to bring biosimilars to market. They don’t have the internal technical expertise to develop biosimilars

- Mylan, Teva, Apotex

- The integrators: Develop both internally developed and in-licensed products and commercialize in developed markets, find local distribution partners in emerging markets. There are only a few companies with the combined technical and commercial skills to develop and market biosimilars in developed markets. Apart from Coherus, all have established biopharma businesses and capabilities prior to entering biosimilars.

- Sandoz, Amgen, Coherus, Celltrion

- The exiters: Prioritized Biosimilars and then decided to exit and focus on core business

- Pfizer, Merck, Momenta

Specific company journeys are shown in the attached “network” diagrams.

Company journeys raise questions such as

- Who is going to develop the next wave of biosimilars for the commercializers? Mylan is a good example to consider. Their main source of products to date has been Biocon. Biocon’s next wave of products are licensed to Sandoz for Developed Markets. Will Mylan continue to bring biosimilars to market?

- Will Biosimilar development now be focused in companies based in China, India and Korea given most development efforts by EU/US major pharma have stopped and no new startups are entering the field? Will these development companies try to move forward to commercialization in developed markets as some are trying to do, e.g. Celltrion with infliximab? If so, how will Developers prioritize products going forward?

- To date only large multi-billion-dollar products have been extensively developed as biosimilars. Will Developers or Integrators start to develop products with smaller dollar potential?

In our next white paper, we will list out the products that should be developed going forward and in future white papers outline what we believe is a viable path to ensure biosimilars are available for practically all biopharmaceuticals regardless of market size.

Legend:

These symbols will aid in reading the network diagrams that appear in the following pages, representing the period from 2002 to till date

Developers: Samsung Bioepis, Biocon, Dr Reddy’s, Lupin, Biothera, Henlius, Prestige, Biocad

Commercializers: Mylan, Teva, Apotex

Integrators: Sandoz, Amgen, Coherus, Celltrion

Exiters: Pfizer, Merck KGaA, Momenta

Sources: Corporate press releases, GABI, The Center for Biosimilars, SBLehrer LLC and IBPS analysis