In the 1990s, it was “generic biologics”. In the early 2000s, “follow-on biologics”. Starting in 2006 regulators settled on the word “biosimilars.” The goal was always the same, produce equivalent versions of blockbuster complex products made by living cells to help manage cost and increase access, just like what occurred with generic pharmaceuticals.

Reaction was swift. Innovator biopharmaceutical companies parroting the same language and approaches used by the pharmaceutical industry in the 1980s to say a “generic pharmaceutical” wasn’t possible tried to ward off biosimilars – biopharmaceuticals are too complicated to reproduce, patient safety will be an issue if one switches between the innovator product and a biosimilar, etc. The arguments were almost identical to those from the 1980s. However, in the end, science and clinical evidence wins. Biosimilars are here and we have seen many innovator companies joining the race along the way.

It wasn’t until 2015 when US FDA approved the first “biosimilar,” Sandoz’s Zarxioâ, could the industry be sure there would be a worldwide biosimilars business. A lot has happened in 5 years. Now the major question has shifted to sustainability. Many companies have come and gone in the biosimilars space. Are biosimilars only viable for first wave blockbuster products? Are prices being driven too low to justify development of biosimilars that will enter the market in the back half of the decade? Who will develop biosimilars for smaller revenue products?

To address these questions, SBLehrer LLC and Integrated Biopharma and Pharma Solution, Ltd. (IBPS) have teamed together to produce a multipart series regarding the biosimilar industry. We take a pragmatic, battle-scarred view. We have worked on “biosimilars” since the late 1990s. Collectively we have developed several biosimilars worldwide. We have assisted governments writing Biosimilar Guidance Documents and Regulations. We have built facilities producing monoclonal antibody biosimilars at $7 per 100mg vial of “final package product out the door” including all fully loaded manufacturing costs. This will enable cancer treatment for a few dollars a day for these important biopharmaceutical treatment options. We have seen what works and what doesn’t.

Our goal is to outline what we believe is a viable path to ensure biosimilars are available for practically all biopharmaceuticals regardless of market size. We will show over a series of articles how we believe one can build a profitable business of biosimilars earning IRRs of over 30% including the cost of building manufacturing facilities, developing products and commercialization. This is with little risk. How many other pharmaceutical projects can match this at the beginning of a project?

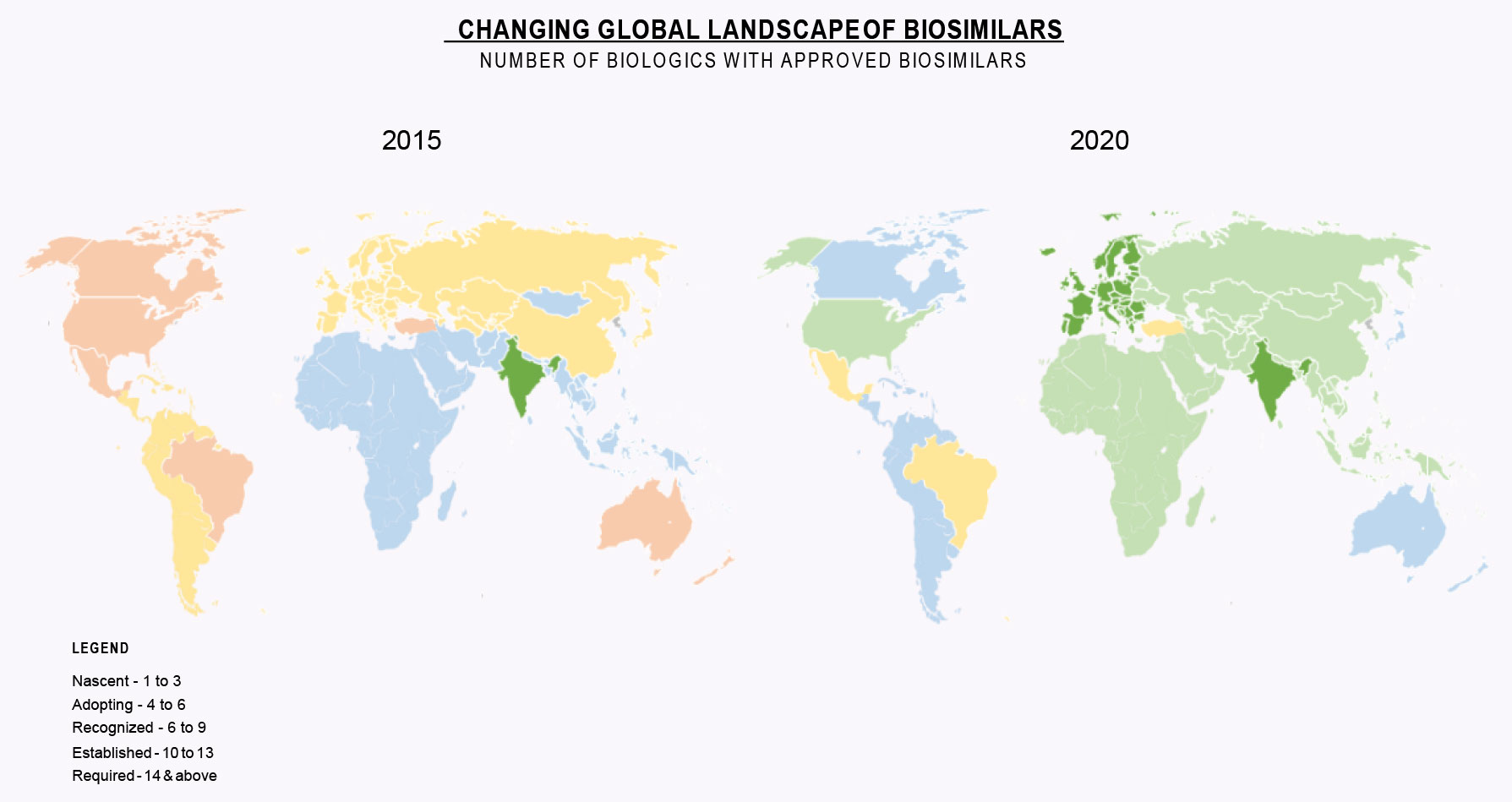

This first installment starts with a look at the last five years and how market acceptance has evolved for biosimilars. We use five stages:

- Nascent: initial products, regulators are still learning how to review and approve biosimilars, the market is unsure of when to use biosimilars

- Adopting: first wave of products is approved and marketed, but still only a handful and biosimilars don’t fundamentally change access or affordability

- Recognized: More products approved, predictable regulatory pathways, several products now have multiple approved biosimilars; payers and healthcare providers setting up policies for use of biosimilars

- Established: patients, payers and healthcare providers understand and routinely use biosimilars

- Required: patients, payers and healthcare providers expect biosimilars to be approved and marketed as soon as legally permissible; some government-based healthcare providers assume launches and make budget decisions based on expected price reductions.

Source: Public Trial/Approval Registries, Gabi, Drug Patent Watch, Springer, SBLehrer LLC and IBPS Analysis

As one can see in the Changing Global Landscape of Biosimilars, the vast major of the world has moved into the Established Phase for Biosimilars. The EU and India are in the Required Phase. Clearly Biosimilars have “Come of Age”.

Our next installment will focus on how current industry players evolved. This is helpful to predict how the market will continue to develop.